Chinese cross-border e-commerce giants TEMU and SHEIN are reshaping air freight by shipping products directly from Chinese factories to consumers in Europe and the US.

This phenomenon has raised concerns about tight capacity and soaring freight rates during this year’s peak shipping season.

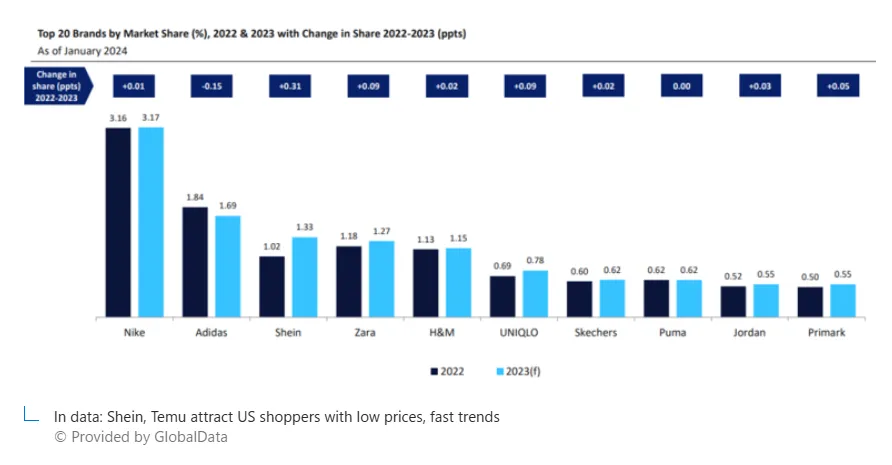

In 2023, SHEIN and TEMU exploded in the US market, attracting many consumers with their meager prices.

Surge in Consumer Demand

Omnisend, an email and SMS marketing platform, surveyed 1,000 Americans about their shopping habits in 2023. The survey revealed that 70% of American consumers shopped on global and Chinese online platforms, with over half (57%) shopping on TEMU, 43% on SHEIN, 33% on TIKTOK, and 20% on AliExpress.

Over half (51%) of American consumers purchased adult clothing from SHEIN, and 37% bought household items from TEMU. Additionally, one in five American consumers shopped at least once a week on TEMU, SHEIN, AliExpress, Amazon, and Etsy.

Impact on Air Freight Capacity

To deliver products faster to European and American consumers, e-commerce platforms are increasingly shipping directly from Chinese factories via air freight. This direct shipping model has led to a surge in shipments from South China, intensifying competition for air freight capacity.

This has resulted in increased air freight costs at major Asian air freight hubs and a capacity shortage, eliminating the traditional distinction between peak and off-peak seasons.

For instance, June is typically an off-season before the year-end holiday shopping peak. However, due to the influence of platforms like SHEIN and TEMU, air freight rates have risen by about 40% compared to the same period last year.

According to Xeneta, a sea and air freight rate benchmark and market intelligence service provider, the average spot price for air freight from South China to the United States in late June was $5.27 per kilogram, more than double that of 2019.

Niall van de Wouw, head of Xeneta’s air freight division, noted that the rapid rise of Chinese e-commerce has drastically changed the air freight market in a very short time.

Rising Global Demand for Air Freight

According to the International Air Transport Association (IATA), global air freight demand surged in May 2023 due to trade growth, booming e-commerce, and constrained sea freight capacity.

Global air freight demand, measured in cargo ton-kilometers (CTKs), grew by 14.7% year-on-year in May 2023, marking six consecutive months of double-digit growth.

Demand in the Asia-Pacific region was particularly robust, with air freight growing by 17.8% year-on-year in May.

The Africa-Asia trade route saw a 40.6% increase, while the Europe-Asia, intra-Asia, and Middle East-Asia routes grew by 20.4%, 19.2%, and 18.6% respectively, with capacity increasing by 8.4% year-on-year.

Shifting Cargo Composition

Traditionally, cargo flights from Asia to Europe and America carry small, high-value items such as smartphones, laptops, fish, and flowers. However, low-cost clothing and household goods from SHEIN and TEMU now dominate air freight capacity.

According to a June 2023 report by the US Congress, TEMU and SHEIN collectively ship nearly 600,000 packages to the US daily. Research by Cargo Facts Consulting in February revealed that TEMU and SHEIN transport approximately 9,000 tons of cargo globally each day, necessitating about 88 Boeing 777 freighters for full capacity.

Industry Giants Respond

TEMU ships 4,000 tons daily, SHEIN 5,000 tons, Alibaba 1,000 tons, and TikTok 800 tons. Yngve Ruud, Vice President of Air Logistics Operations at Swiss freight forwarder Kuehne + Nagel, noted that TEMU and SHEIN were insignificant players in the air freight market in 2022. By the end of 2023, they had become the world’s top two air freight shippers.

DHL Global Forwarding CEO Tim Scharwath highlighted that within two years, Chinese e-commerce platforms have rapidly expanded, claiming over 30% of cargo space on Asia-origin flights.

DHL Global Forwarding urges retailers and manufacturers to secure air freight contracts early to avoid missing out on opportunities during peak shopping seasons. Waiting until October to request additional air freight may lead to unmet demand.

Increasing Air Freight Capacity

To alleviate air freight pressures, particularly from China, many international airlines are launching new flights and increasing capacity.

For instance, Atlas Air partnered with YTO Express to introduce a second cargo plane between China and the US.

Korean Air plans to meet rising e-commerce demand from China by bolstering customer partnerships and allocating capacity on key routes.

However, these efforts are insufficient to meet the demand from e-commerce platforms. Even with anticipated growth in cross-border e-commerce over the next 5-10 years, global long-haul wide-body cargo plane capacity is expected to remain tight.

Amazon Joins the Race

Amazon has also launched a similar direct shipping service from China. On July 1, Amazon announced a new dedicated section on its main website offering unbranded products priced under $20, shipped directly from China to US consumers.

This strategic move is seen as Amazon’s response to growing competition from Chinese e-commerce giants like TEMU and SHEIN. If Amazon’s direct shipping service gains traction, competition for air freight space could intensify during this year’s peak shopping season.

Conclusion

Chinese e-commerce platforms such as TEMU, SHEIN, TIKTOK, and AliExpress have emerged as formidable global forces. Their direct shipping model from Chinese factories to global consumers is disrupting traditional markets, reshaping the global e-commerce landscape, and influencing the air freight industry.

The air freight sector must adapt swiftly to this new reality. As Basile Ricard, Operations Director for Greater China at freight forwarder Bolloré Logistics, emphasized, the most significant factor impacting air freight today isn’t geopolitical conflicts but the rapid ascent of Chinese e-commerce platforms like SHEIN and TEMU.