Airsupply is an international freight forwarder with one-stop solutions for air, sea, and ground shipping, and we are experts at handling special cargo.

Airsupply provides timely services for your shipments whether FCL, LCL, or consolidated. We offer economical and efficient forwarding options ranging from air freight, sea freight, road or rail freight, and Amazon FBA.

We have a team of experts in various special freight forwarding services, such as hazardous and sensitive cargo.

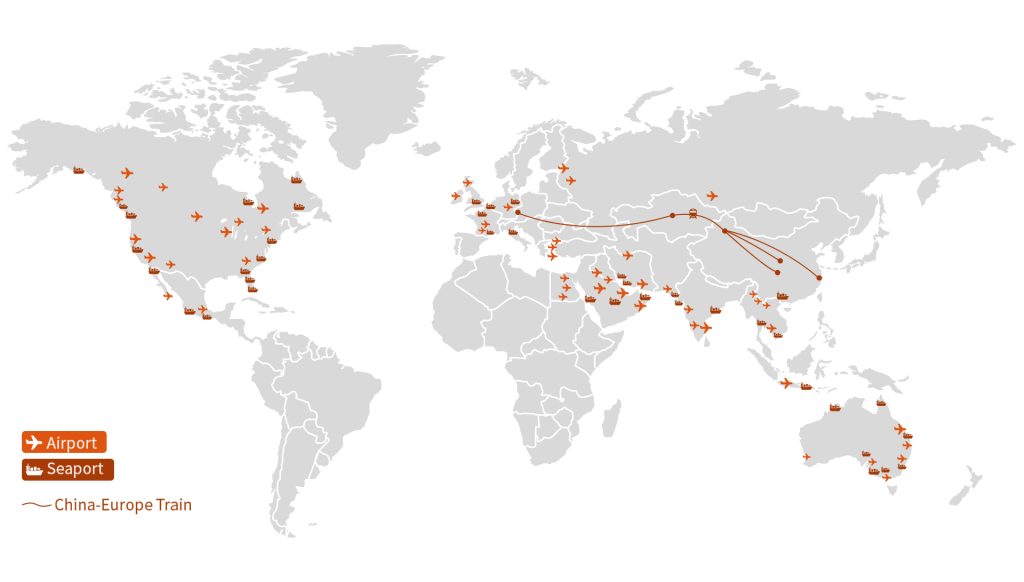

Airsupply International Logistics Group Ltd started in 2016 with the approval of the Ministry of Trade and the CAAC. We engaged in third-party logistic (3PL) services targeting air, sea, and e-commerce for supply chains going worldwide,such as North America, Europe, the Middle East, and Southeast Asia.

We aim to provide top-notch international shipping service for our clients. ASLG’s team of logistic specialists offers various logistic solutions that suit any type of shipment, even hazardous or sensitive cargo requiring special handling. And we can help you boost the supply chain and receive the goods safely and smoothly.

Airsupply got your back in handling your precious cargo. We are trained to handle delicate cargo, ranging from batteries to automotive and hazardous goods that require permits and precautions while shipping.

We aim to provide top-notch international shipping service for our clients. ASLG team of logistic specialists offers various logistic solutions that suit any type of shipment, even hazardous or sensitive cargo requiring special handling. And we can help you boost the supply chain and receive the goods safely and smoothly.

Airsupply got your back in handling your precious cargo. We are trained to handle delicate cargo, ranging from batteries to automotive and hazardous goods that require permits and precautions while shipping.

We got your back by assisting you in consolidating goods from different suppliers and dispatching them as your requests. Our warehousing system provides a cost-effective way of efficiently handling inventory.

ASLG provides transparency on cargo by using cutting-edge tracking method. We update clients on their cargo and the ETA and also check for any causes of delays.

These guys made my vape shipping that little bit hassle-free. They are well aware of the policy of importing e-cigarettes into our country. Really impressed they packed my vape batteries professionally.

Helpful chat support, timely email updates, and great options for shipment. Exceptional thanks to Ivy who always helps me out with issues arising. Never leave me hanging.

Despite my initial concerns about trusting anyone to ship my electric vehicle, their hazmat team for the continuous analysis of potentially hazardous materials was helpful and professional. I'll definitely use ASLG service again.

The team did an excellent job getting my goods delivered from China to Amazon FBA. It was completed fast and efficiently. No fuss and no worries. The competitive rates as well.

99% Punctual Delivery

Track Everything Effortlessly

Direct Agent Price

All Shipping Modes; Every Cargo Type